iProperty Malaysia observes a positive outlook for Johor’s property market, fueled by the development of the Rapid Transit System (RTS) Link. The RTS Link, slated for completion by the end of 2026, is proving to be a catalyst for the southern state’s economy by enhancing connectivity with Singapore and revitalising the local property market, especially in Johor Bahru.

In the past few years, Johor’s residential property market has grappled with a significant overhang issue, exacerbated by the COVID-19 pandemic. However, with the onset of post-pandemic recovery and recent advancements in transportation infrastructure, Johor is poised for a turnaround.

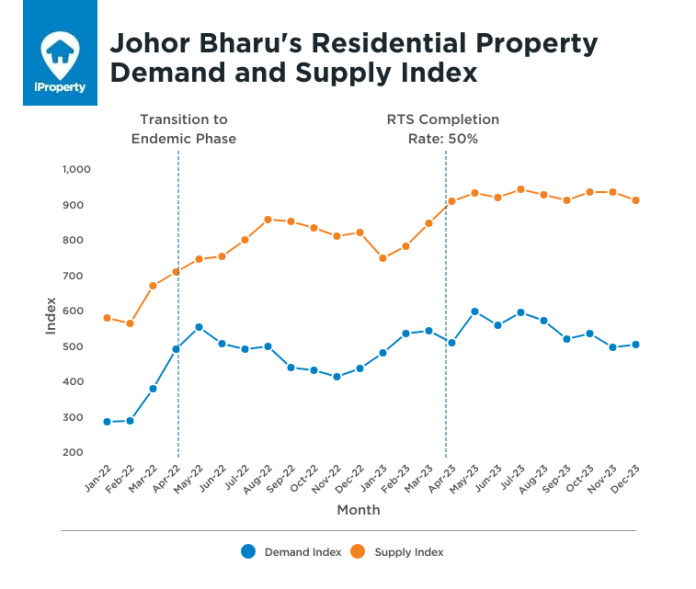

Following the announcement of the endemic phase in April 2022, iProperty Malaysia saw a 29% surge in Johor Bahru’s property demand index. Similarly, as the RTS Link reached 50% completion in April 2023, the demand index for Johor Bahru properties climbed by 17%. These demand trends are in line with NAPIC’s Property Market Report 2023, which noted a 20% decrease in Johor’s unsold property units from 5,258 in 2022 to 4,228 units by 2023.

Sheldon Fernandez, Country Manager, PropertyGuru Malaysia (PropertyGuru.com.my and iProperty.com.my), said, “Johor is undergoing a notable transformation, transitioning from being the state with the highest overhang property to a more favourable position. This improvement is attributed to various initiatives undertaken by the state, including the development of the RTS Link, the designation of Forest City as a special financial zone (SFZ), the proposed Johor-Singapore Special Economic Zone (SEZ), and the potential revival of Kuala Lumpur-Singapore high-speed rail (HSR). These efforts have not only boosted property demand but also enhanced property values.”

2023 Most Viewed Service Residences in Johor Bahru: Top 10 Consumer Picks

According to NAPIC, Johor emerged as the leading state in the 2023 Malaysian House Price Index (MHPI), showcasing an encouraging annual home price growth of 6.2%. In comparison, the runner-up, Penang, achieved a growth rate of 3.8%. Considering Johor’s MHPI improvement and the RTS Link development in Johor Bahru, iProperty Malaysia took a closer look into the capital city’s residential property transactions in 2023.

Based on actual transactions captured by brickz.my from December 2022 to November 2023, it was found that 70% of the non-landed properties transacted belong to the service residence category. Keeping this in mind, iProperty Malaysia further explores the investment opportunities available in 2024 by delving into the price growth trends and identifying the most sought-after properties in the service residence category.

“We are seeing a significant year-on-year (YoY) median asking price growth of 20% for service residences in Johor Bahru. The smaller unit in particular recorded robust price growths – with the 501-750 sq ft category recording 27%, 751 – 1,000 sq ft recording 18% and 1,001 – 1,250 sq ft recording 15%. This could indicate that the advantage of seamless connectivity outweighs the preference of larger living spaces due to lower entry cost and closeness to a main mode of transportation.

Meanwhile, according to the Global Property Guide*, the average gross rental yield in Malaysia stands at 5.16% as of Q1 2024, with Johor surpassing the national average at 6.25%. When examining the gross rental yields for the 10 most popular projects, more than half exhibit yields exceeding 5.00%. Though not exceptional, these figures offer some promise when compared to the nation’s average rental yield. We believe this presents an opportunity for investors seeking properties with promising rental returns,” said Sheldon.

| Property | Total Views | Median Price per sq ft | Median Price | Gross Rental Yield |

| R&F Princess Cove | 39.76% | RM806 | RM722,500 | 5.00% |

| Twin Tower Residence | 10.28% | – | – | 3.60% |

| Green Haven @ Kota Puteri, Johor Bahru | 8.76% | RM549 | RM697,400 | 6.70% |

| Marina Cove, Johor Bahru | 7.09% | RM701 | RM633,400 | 4.30% |

| Southkey Mosaic, Johor Bahru | 6.70% | RM592 | RM526,000 | 3.20% |

| Twin Galaxy Residences, Johor Bahru | 6.63% | RM620 | RM580,000 | 5.00% |

| Country Garden Central Park (Serviced Apartment) | 5.82% | RM710 | RM700,000 | 4.90% |

| Palazio, Tebrau | 5.54% | RM475 | RM240,000 | 5.30% |

| D’Summit Residences, Skudai | 5.06% | RM595 | RM460,900 | 5.80% |

| Tropez Residences@ Tropicana Danga Bay | 4.43% | RM509 | RM395,000 | 5.80% |

Note: Purchase price and monthly rent figures are based on listings on iProperty.com.my. Thus, these figures are an estimate as the final purchase price or monthly rental could vary upon negotiations.

Key Factors Driving Top-Viewed Projects Popularity

One of the main reasons why the projects above appeared as most viewed is their proximity to the RTS LInk. For example, R&F Princess Cove and Twin Tower Residence are located 2.1km and 900m away from the RTS Bukit Chagar station, respectively. This provides Malaysian residents who work across the border with the advantage of both an easy access to Singapore as well as combating the high rental prices in Singapore. Similarly, Singapore’s cooling measures, which included the increase in Additional Buyer’s Stamp Duty (ABSD) could encourage Singaporean investors to consider properties in Johor.

Secondly, most properties on the list are freehold, indicating a preference on the type of tenure that allows owners to have greater control over their properties. While freehold tenure is a key factor for many buyers, other considerations such as location, amenities, infrastructure, and future plans also affect homebuyers’ purchase decisions.

Moreover, most of the developments were completed between 2014 and 2018, except for Twin Tower Residence having completed in 2023/2024. Property seekers could be enticed by subsale properties, where the surrounding infrastructure and amenities have had some time to mature and could still grow. In addition, subsale properties offer the distinct benefit of providing historical data on the quality of building management and maintenance, as well as demographic information about the residents. This can be invaluable for savvy buyers who seek due diligence on the property’s upkeep and the community living there.

Also, these developments’ unique attractions and strategic location play a crucial role in the popularity of service residences. For instance, Twin Tower Residence is near the Johor Bahru CIQ complex, RTS Bukit Chagar station, and several malls. D’Summit Residences is close to the Kempas exit of the North-South Highway, CIQ Complex, Fairview International School, and AEON.

“As we reflect on the past year, it is evident that Johor’s property landscape has undergone a period of growth, resulting in the surge in demand for properties in the state, especially in Johor Bahru. Investors and homebuyers seeking to capitalise on this momentum should carefully consider Johor Bahru and its surrounding suburbs. With the development of major projects, such as the RTS and other initiatives that position Johor as an emerging hub of economic activities, the outlook for the state appears promising. The ongoing developments and anticipated economic growth could lead to attractive investment prospects in the real estate sector,” said Sheldon.

* * ** * ** * ** * ** * ** * ** * *

- The views data is sourced from iProperty.com.my and PropertyGuru.com.my between January 2023 and December 2023, and it does not represent the whole residential property market in Malaysia.

- The term organic search is defined as when a property consumer searches for a property in a certain location and lands on a search result page on iProperty.com.my or PropertyGuru.com.my.

- Analytics from brickz.my is based on the data available at the date of publication and may be subject to revision as and when more current data becomes available. Readers are encouraged to seek independent advice before making any investment.

- * The Global Property Guide utilised asking price data from propertyguru.com.my for both buying and renting prices to determine the average gross rental yields (Monthly Rent x 12 / Purchase Price).