My friend had recently asked me if this is the time to sell everything and keep cash as the market is bearish and everyone is afraid of the upcoming collapse. She sounded so certain that a collapse was around the corner but sure enough, the Dow Jones Industrial (DJI) plunged 800 points on 14th August 2019, because of the inverted yield curve. Indeed, the market has been turbulent since May this year, and even though the US Federal Reserve Bank had a rate cut of 25 basis point on 31st July 2019, it did not manage to stimulate the market. Two days later, President Trump announced an additional 10% tariff on $300 billion worth of goods for China. In return, China allowed its currency to fall to a more-than-10-year low, seeing the DJI tank to 767 points. To make things worse, the US Treasury department designated China as a currency manipulator. The irony is, Trump softened again and announced that he has delayed the 10% tariff to December.

So, what would come next? No one knows. One thing for sure is that volatility would persist. Therefore, I’m going to discuss how to profit from volatility. First, let us have a look at our portfolio on 15th August 2019 amid such uncertain times.

The companies or strategies mentioned in this article are meant for study purpose only. It doesn’t constitute any ‘buy’ or ‘sell’ recommendation. Please consult your financial professional if you want to make any decision.

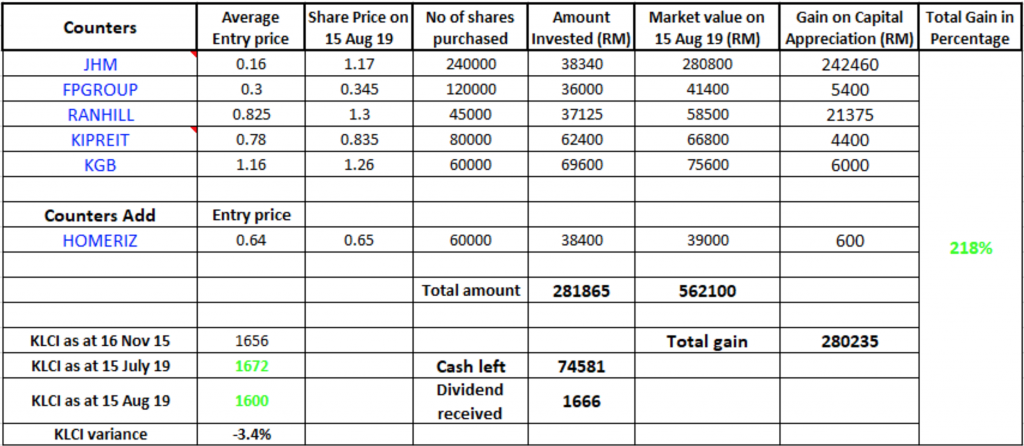

The portfolio has showed a gain of 218% since November 2015, which is 8% lower compared to a month ago. We received dividends of 1 and 1.52 cents from RANHILL and KIPREIT, respectively. Total dividend received is RM1666.

We adopted the switch strategy to sell Notion at 0.55 and GFM at 0.43 and buy Homeriz at 0.64, after seeing the furniture maker’s earnings stability, high ROE, strong cash flow and good dividend yield. The cash on hand has now increased to RM74581.

In times of volatility

While not many people like volatility, there are traders who make good money in volatile times. How do they do it? The key reasons are ‘Stock Selection’ and ‘Strategy’.

Stock Selection

Some traders only refer to technical tools for trading. However, to increase the probability of winning, one needs to be particular in picking the right company. In other words, company with sound fundamentals does matter. Select companies with the following traits:

1) PE of 12 or below

Companies with low PE means its valuation is more attractive. By selecting companies with low PE, it means you would have higher margin of safety and lower risks.

When you see a company with PE of 12, make sure the company’s yearly earnings growth rate is at least 12% or more, or there is no meaning in such low PE. In Malaysia, there are still quite a number of companies with lower PE, such as Homeriz, Johotin, Favco, Bauto, Tunepro, Pantech, Gkent to name a few. So do these companies have good growth rate? It brings us to the next point.

2) Earnings Visibility

Does the company have high outstanding contracts? How many years can it last? The company might have completed building a new plant but when will the new plant start contributing revenue? The company has developed a new product and what is the potential revenue it could generate, and when it will start generating?

Find out these crucial information from the company’s annual report, quarter report and through attending the AGM. Also talk to your friends who are familiar in the industry.

3) Earnings Stability

Though it may not be exactly consistent earnings, it’s likely to lead to stable share price. Therefore, only buy companies with stable or improved quarter earnings. After all, we all do not like surprises. No matter how volatile the market is, share prices would move in tandem with earnings eventually.

4) Dividend Payer

If a company can pay regular dividend in the last few years, it means it has good cash flow. This is crucial because a company with good cash flow means it has good earnings. The dividend yield does not have to be more than 4%. So long as the company shows good record in paying regular dividends, investors would have much higher confidence.

Conclusion

In bad times, we need to be more stringent in stock selection because share prices tend to be more resilient when the market is panic. In the next issue, we will talk about strategies to adopt in volatile times.