Time to Buy on Dip?

Traditionally, May is a month investors are scared off the most, as statistically, the stock market tends to have big corrections in May. As the saying goes “Sell in May and Go Away”. In May this year, this adage became a fulfilled prophecy. The main reason is the unpredictable trade progress which resulted in steep correction in the global stock market. The question is, is it a good time to buy on dip?

What I have learned in life is that, there is no such thing as a ‘sure thing’. While US Treasury Secretary Steven Mnuchin in April said a US-China trade agreement would go “way beyond” previous efforts to open China’s market to US firms, President Trump said in May that the trade talk was going too slowly, and “They broke the deal”, followed by increasing the tariff from 10% to 25% to China. In return, China raised tariffs for some US goods. With these gestures, the Dow Jones Industrial (DJI) plummeted tremendously in matter of days, setting potentially the worst May tumble in nearly 50 years. To make things worse, the US Treasury yield curve inverted again on 13th May 2019, with the 10-year note yield falling below the yield of the 3-month bill, indicating heightened risk of recession.

Locally, Malaysia saw the worst net flow of foreign funds on a year-to-date (YTD) basis in ASEAN in the middle of May 2019, with a net outflow of US$801.3 million. As a result, the Malaysia Composite Index (FBMKLCI) fell below the critical support of 1600 on 14th May 2019, marking the lowest since 2016.

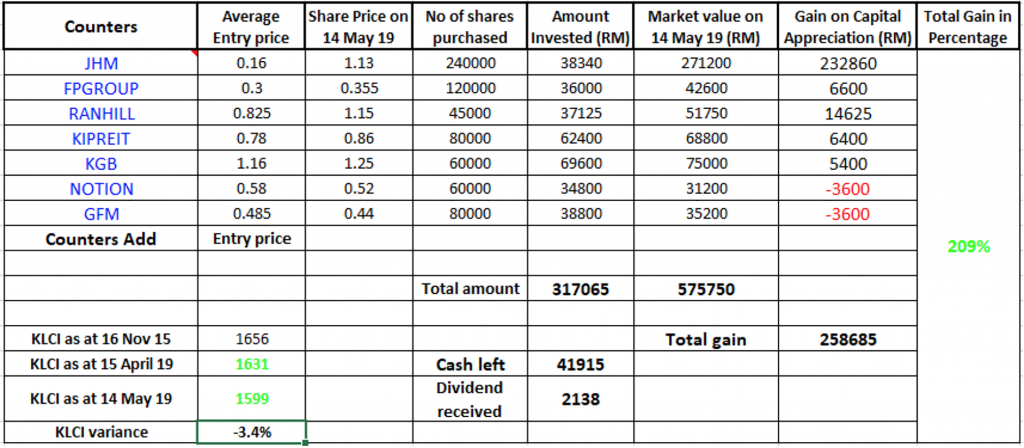

With huge volatility globally and internally, is it a good time to buy on dip? Before we zoom into it, let’s look at our portfolio on 14th May 2019:

The companies or strategies mentioned in this article are meant for study purpose only. It doesn’t constitute any ‘buy’ or ‘sell’ recommendation. Please consult your financial professional if you want to make any decision.

Our portfolio has showed a gain of 209% since November 2015, but a 36% decrease from April 2019. In times of volatility, we stayed put and did not perform any transaction. There were dividends from Ranhill, Kipreit and KGB at 1 cent, 1.51 cents and 0.80 cents, respectively. Total dividend to be received is RM2138.

So does the correction offer an opportunity to buy on dip? It depends on two factors. First, if the share price of the desired company is attractive (great value), secondly, the trade progress. In different perspectives, the increased tariffs to China do not serve US well in the long term. There are a number of reasons:

1) The trade deficit between the US and China has widened in 2018 since the trade war started in 2017. This shows that the US did not manage to reduce trade deficit even after increasing tariffs to China.

2) The increased tariffs could wipe out the benefits from Trump’s tax reform. According to the US National Economic Council chief Larry Kudlow, it was American business that paid the tariffs on any goods brought in from China, and that US consumers would foot the bill if firms passed on the cost increase. If this is the case, higher tariffs to China would lead to higher inflation for the US.

3) Higher inflation may cause the Federal Reserve Bank (Fed) to hike interest rate which is bad for the stock market. Look at what had happened to the stock market in 2018? The Fed increased interest rate four times. And moving into 2019, the Fed assured it would back off from rate hikes, and the market performed much better.

4) While China exports more to US than the other way, China is a huge market for US companies. For example, sales revenue of Apple totaled $46 billion in China, making it the company’s second largest market after US. There are more giant companies like Boeing, Nike, Starbucks to name a few, selling products to China.

5) The US is heading to the President Election next year. If Donald Trump does not strike a deal that is good for the US economy, its stock market and most importantly the US citizens, it is unlikely he will be re-elected.

Conclusion

Since the ongoing trade war would do more harm than good for the US, I trust the two largest economies would eventually reach a deal. With this, I believe a correction due to trade spat would serve as an opportunity to accumulate good quality business with an attractive valuation.

Binyuen is the founder of BY Enrich Resources and the author of ‘Life beyond the Comfort Zone’ and ‘Profit from Share Investment’. His books are available in major bookstores in Malaysia, Singapore or online http://www.teybinyuen.com/profitfromshareinvestment